Dr. Thomas Skuzinski, Chair of the Department of Public Administration at Northern Illinois University, was the featured speaker at the KCDW docuseries entitled “Young Americans and the High Cost to Rent or Own.” Dr. Skuzinski began his presentation by talking about the factors that led to the current housing crisis in America and the role that urban and regional planning can play in solving this crisis. He started with the late 1940s, another time period when there was a housing crisis in America when GIs came home from the war and were getting married and starting families. At the end of that decade, Congress passed the Housing Act of 1949, which stated that the national housing goal was a “decent home in a suitable living environment.”

The professor asked “What is our national housing goal today?” Just like families in the 1940s, we all want a decent home in a suitable living environment. Today we also ask, “Is the home affordable?” And what are some of the problems with housing today? One is the lack of economically diverse neighborhoods. In the 1960s and 1970s, most neighborhoods were diverse with high, middle, and low-income housing in the same neighborhood. During that time, government worked with the private sector to build affordable housing. Later, housing was built to concentrate low-income families in one area. One example of that was Cabrini Green in Chicago, which was later torn down. Today, the voucher system is used, and it is an underfunded program with only one person in four who meet the qualifications receiving a voucher to help with the rent.

Most planned communities today consist of homes in the same price range, and since it’s more profitable for builders to build expensive homes with high-end features, that’s what they do. Thus there is an affordability crisis affecting people of all ages but especially young people starting out who have high student loan payments and seniors who have less income than they had when they were working. It is very difficult for these two age groups to qualify for a mortgage.

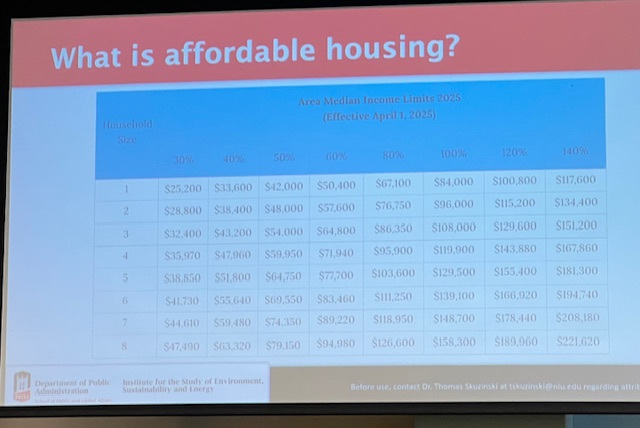

Banks and mortgage companies state that housing costs should not be more than 30% of family income, but in many cases housing costs are 50% or more of family income with two people working. Low-income families (family of 3) who are paying 30% of their income for rent can afford $810 a month and usually have an annual income around $32,400. With utilities, the housing cost is around $1,350 for a low-income family, and that doesn’t include food and other necessities. In Kane County, it is almost impossible to find an apartment for that amount.

Middle-income families (annual income of $100,000) who hope to buy a home need about $26,800 in cash to cover the closing costs and the 3.5% down payment for a median-priced home. The median-income house in Chicago is at the higher end of the range. It recently rose to $370,000. A family would need a yearly income of $128,000 to make the monthly mortgage payment of $3,300 a month, which includes principal and interest.

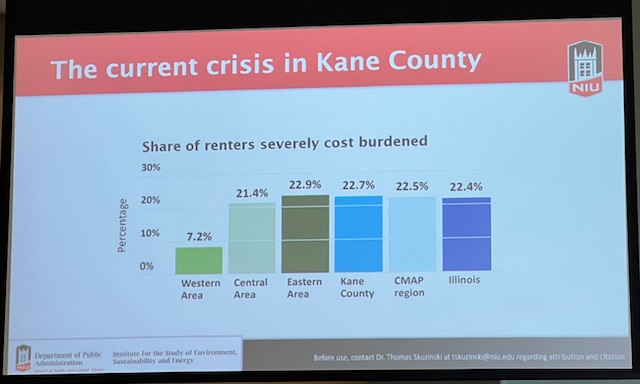

Kane County has mostly single-family housing, and it’s hard for young people and seniors to find studio and one-bedroom apartments. There are not enough units being built. Many people over 70 can’t afford a two-bedroom apartment in Kane County. Other countries in Europe solve this problem by requiring developers to set aside 30% of available apartments for low-income housing. That has not been a priority in America. Overall, Kane County is providing for low- and middle-income renters, but the county has few provisions for extremely low-income renters.

Nationally, the home ownership rate for households under 35 years old has fallen to about 37.4% (down from a high of 45% in 1960; 42% in 1980). For the “prime” home buying years (35-44 age group), home ownership has dropped from 70% (1960) to 60% (2024). Homelessness of youth is also on the rise. Each year, an estimated 4.2 million teens, young adults and youth experience homelessness in the U.S. About 700,000 of these are unaccompanied minors. And four out of every ten new cost-burdened households since 2019 were made up of residents who were 18 to 35 years old. Five of those households were seniors over the age of 65, and three of those households were seniors over age 75. Currently, we need 4,000,000 new units, and the demand for income supplements and vouchers is growing. There are long waiting lists, and it can take years for a family to move to the top of the list.

What are some of the causes? America has low-density use of land, and there are several reasons for this. One is NIMBY (not in my backyard). Homeowners believe that multi-unit housing brings down house values, and they want to restrict neighborhoods to single-family homes. Some solutions are to turn empty commercial buildings into housing units, but homeowners complain for the same reason when these suggestions are made. Government restrictions are another problem. The Trump administration (through budget proposals), made a 43% cut to the rental assistance program, which supports more than 5 million low-income households. Work requirements were added to obtain assistance, and there is now a two-year limit on federal assistance for the able-bodied. The administration has also consolidated major federal housing programs like Housing Choice Voucher (Section 8), public housing, and project-based rental assistance into state-administered block grants. Programs such as the Community Development Block Grant (CDBG) and the HOME Investment Partnerships Program have been eliminated.

How can we overcome these roadblocks? Do the opposite of what we have been doing. Start now thinking about how we can make things better. One way is to change the zoning code and build diverse economic neighborhoods again. We need representation of all ages and income brackets at our zoning meetings, so we can meet the goal of decent homes in a suitable living environment just as our parents and grandparents did many years ago.